- 1. Why Does Investment in Compliance Pay Off?

- 2. How Does a Compliance Program Improve Company Financial Performance? 5 Key Methods

- 2.1. 1. Avoiding Regulatory Penalties and Costs of Non-Compliance

- 2.2. 2. Reducing Losses from Fraud and Security Incidents

- 2.3. 3. Increasing Operational Efficiency Through Process Automation

- 2.4. 4. Protecting and Strengthening Corporate Reputation

- 2.5. 5. Increasing Shareholder Value and Access to Capital

- 3. How to Effectively Implement a Compliance Management Program?

- 4. How Much Does Compliance Program Implementation Cost and What Is the Return on Investment?

- 5. What Are the Biggest Challenges in Compliance Management in 2026?

- 6. Compliance Trends for 2026-2027: What Awaits Us?

- 7. FAQ – Frequently Asked Questions About Compliance Programs

- 7.1. Does every company need a formal compliance program?

- 7.2. How long does compliance program implementation take and when will we see return on investment?

- 7.3. What are the key differences between compliance and risk management?

- 7.4. Can compliance automation completely replace specialists?

- 7.5. What are the most important metrics for measuring compliance program effectiveness?

- 8. Summary – Compliance as Strategic Investment

An effective compliance program is not a cost but an investment that pays back by avoiding penalties (average of 4.88 million USD for data breaches, according to IBM), reducing operational costs through automation, and increasing company value by building investor trust. In 2026, growing regulatory complexity forces a strategic approach to compliance as an element of building competitive advantage.

Compliance program transforms from cost centre to strategic driver of financial growth

A compliance management program today is much more than just protection against regulatory penalties. In an era of increasing regulatory complexity, where 85% of organisations globally report increased regulatory requirements, a properly implemented compliance program becomes a competitive advantage and a real source of financial value.

Why Does Investment in Compliance Pay Off?

Costs of non-compliance reached record levels in 2024-2025. According to the IBM Cost of a Data Breach 2024 report, the average global cost of a data breach was 4.88 million USD – the highest level in history, with a 10% year-over-year increase. For organisations that experienced a breach with a regulatory non-compliance factor, costs were significantly higher.

The situation in the regulated sector is particularly demanding. Financial institutions face growing operational costs related to compliance, and healthcare organisations, according to the Ponemon Institute, spend an average of 8.2 million USD annually on data governance related to compliance.

However, organisations that treat compliance strategically achieve measurable benefits. The PwC Global Compliance Survey 2025 shows that 77% of respondents cite growing compliance complexity as affecting their ability to achieve business objectives, underscoring the need for a strategic, not reactive, approach to compliance. Companies investing in modern compliance technologies report concrete benefits: 64% better risk visibility, 53% faster problem response, 48% higher reporting quality, and a 43% increase in productivity, with cost savings.

How Does a Compliance Program Improve Company Financial Performance? 5 Key Methods

1. Avoiding Regulatory Penalties and Costs of Non-Compliance

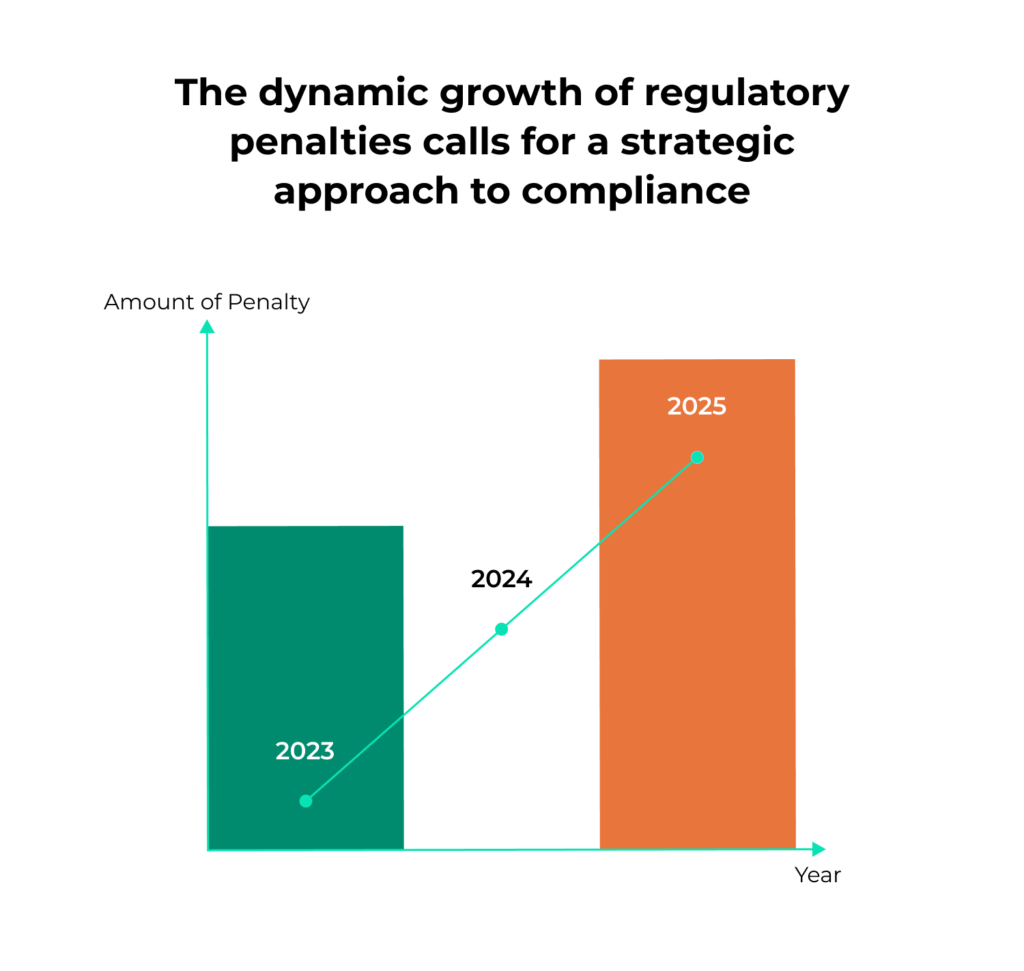

The most obvious, yet often underestimated, benefit is the elimination of costly sanction risk. The amount of penalties for non-compliance is growing at an alarming rate. By March 2025, the total value of GDPR fines in the European Union exceeded 5.65 billion euros, with numerous individual fines reaching hundreds of millions of euros for the largest technology companies.

An effectively implemented compliance management program acts as a protective shield, minimising the risk of violations through clear procedures, regular audits, and automated compliance monitoring. In the banking sector, where customs controls increased by 54% in 2025, and projected unpaid duties and penalties are expected to increase by 787% (from 667 million USD to 5.9 billion USD according to AAEI data), a proactive approach to compliance is the difference between stability and financial catastrophe.

2. Reducing Losses from Fraud and Security Incidents

According to the Ponemon Institute report, 54% of organisations experienced a cyberattack in the last year, and the global average cost of a data breach reached the aforementioned 4.88 million USD in 2024. Particularly important, organisations that extensively used artificial intelligence and automation in prevention saved an average of 2.2 million USD compared to those that did not.

Compliance programs that integrate solid internal control mechanisms, vendor due diligence procedures, and regular internal audits build a multi-layered defence against financial abuse. Third-party risk management becomes particularly important – a 2025 Gartner study found that over 82% of compliance leaders experienced negative consequences related to vendor risk in the past year. DBIR 2025 additionally showed that breaches involving third parties doubled from 15% to 30% within a year.

3. Increasing Operational Efficiency Through Process Automation

Compliance process automation is currently the fastest path to achieving measurable ROI. Industry reports and GRC solution provider case studies suggest that automation can lead to significant operational cost reduction, often in the tens of percent range, depending on organisation size and specifics.

Gartner predicted that by 2025, compliance departments would reduce annual training by 50%, shifting costs toward embedded workflow controls. According to Gartner research from 2021, organisations that implemented such mechanisms noted a drop in the number of employees bypassing compliance obligations by more than half (58%). Companies implementing embedded compliance controls observe improvement in task completion indicators and a reduction of compliance-related employee burden.

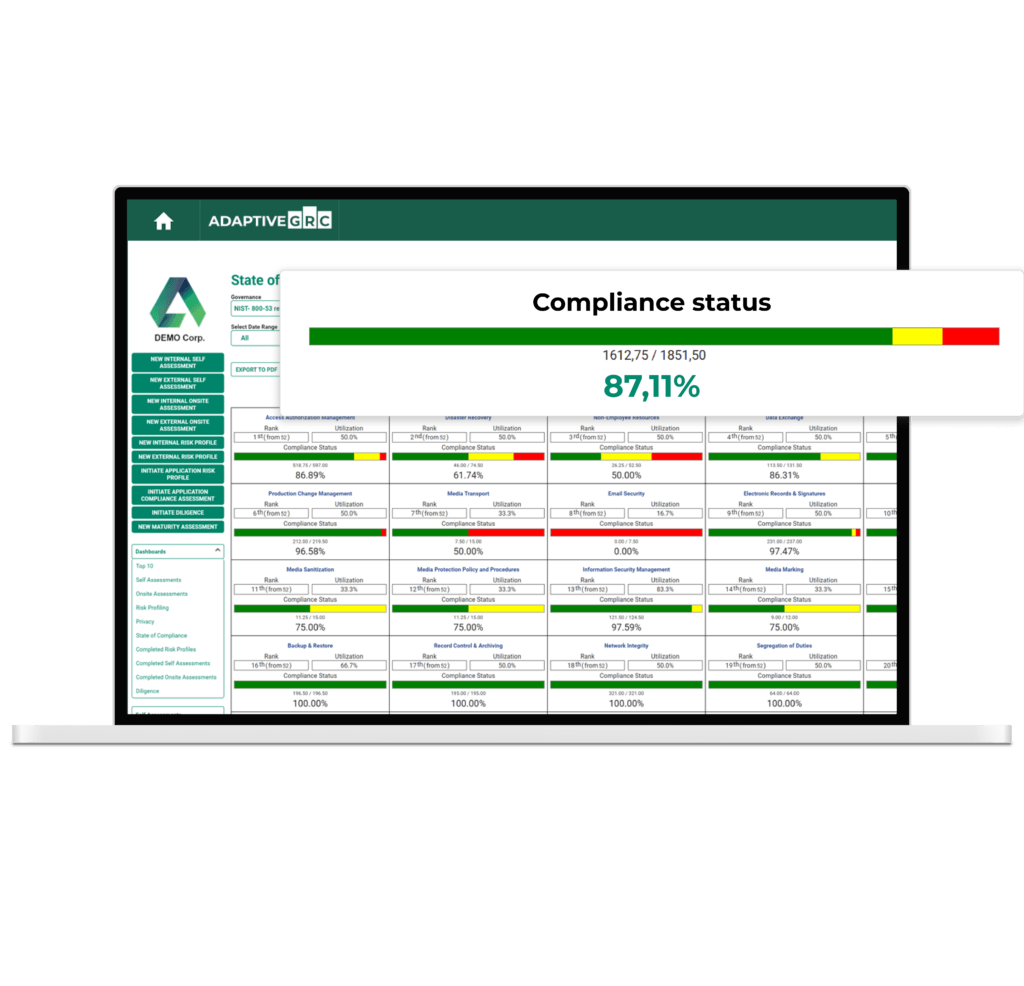

Modern GRC platforms, such as AdaptiveGRC, centralise data on risks, controls, and audits, creating a single reliable version of truth. The aforementioned PwC 2025 study shows concrete, measurable benefits of compliance technology: 64% better risk visibility, 53% faster problem response, 48% higher reporting quality, and 43% productivity increase with cost savings.

Comparison of compliance costs and benefits – manual vs. automated approach

| Area | Manual Approach | Automated Platform | Efficiency Improvement |

| Audit preparation time | 4-6 weeks | 1-2 weeks | Significant time reduction |

| Annual operational costs | 100% baseline | Potentially lower | Depends on organization |

| Human error risk | High | Minimal | Dramatic reduction |

| New control implementation time | 3-6 months | 2-4 weeks | Process acceleration |

| Real-time risk visibility | Limited | Full | 64% improvement (PwC) |

Note: Specific savings depend on organization size, industry, and compliance process maturity level

4. Protecting and Strengthening Corporate Reputation

The reputational value of a compliance program is often difficult to quantify, but its impact on financial results is undeniable. In the era of corporate social responsibility and ESG (Environmental, Social, Governance), compliance with environmental and social regulations has become a key decision factor for investors and customers.

The PwC 2025 study indicates that nearly one-third (30%) of all organisations place environmental and sustainability regulations in the top five most important compliance risks. In the energy, utilities, and resources sector, this percentage reaches 50%. Companies that proactively implement ISO 27001 and NIS2 compliance build trust and position themselves as responsible business partners.

The Wells Fargo case shows how costly compliance scandals can be. After revealing the creation of 2 million fake bank and credit accounts between 2011 and 2015, the bank faced not only regulatory fines but also a dramatic drop in customer and investor trust, which translated into a long-term decline in stock value and multimillion-dollar reputational losses.

5. Increasing Shareholder Value and Access to Capital

A compliance program that effectively manages risk and promotes transparency directly impacts increased investor trust. Organisations with certified management systems (SOC 2, ISO 27001, CSRD) often note concrete business benefits beyond compliance itself.

GRC solution provider case studies show examples of companies that, after implementing automatic monitoring and obtaining SOC 2 certification, significantly shortened sales time and closed larger contracts requiring such certifications. One technology company, after accelerating the certification process from 12 to 5 months, closed contracts worth 4.2 million USD requiring this certificate, with an investment in compliance tools of 80 thousand USD.

For every 10% increase in concentration on material ESG issues (those relevant to core business operations), organisational value grows by approximately 1.4% according to market analyses. This underscores growing expectations from investors and regulators that companies will treat ESG compliance not as an add-on but as a key element of strategy and operations.

How to Effectively Implement a Compliance Management Program?

Simply having compliance documentation is not enough. The key is a strategic approach based on three pillars:

Advanced communication and compliance culture. Clear policies and procedures, regular training, and open communication about legal and ethical requirements create an environment where compliance becomes a natural part of daily work. Gartner emphasises that embedded workflow controls are significantly more effective than traditional training – companies implementing these mechanisms observe significant improvement in employee compliance obligation fulfilment.

Increased transparency through digitalisation. Modern compliance platforms, such as AdaptiveGRC, ensure financial transparency, reporting accuracy, and real-time data security. These systems eliminate information dispersal in spreadsheets and emails, replacing them with a centralised, accessible source of truth. For organisations managing multiple compliance frameworks (GDPR, NIS2, ISO, SOC 2), this means the possibility of a significant reduction in control duplication and manual work.

Proactive risk management. Effective enterprise risk management requires not only threat identification but also quantification, prioritisation, and continuous monitoring. Organisations using artificial intelligence and automation in threat prevention save an average of 2.2 million USD on data breach costs, according to the IBM report.

How Much Does Compliance Program Implementation Cost and What Is the Return on Investment?

Compliance program implementation costs vary and depend on organisation size, industry, and regulatory requirement complexity. According to Deloitte estimates, organisations in the financial sector allocate 4-7% of IT budget to data governance and regulatory compliance. Healthcare organisations according to the Ponemon Institute, spend an average of 8.2 million USD annually on data governance related to compliance.

Return on investment manifests in several key areas:

Time and resource savings. Automation eliminates a significant portion of routine compliance tasks, translating into the ability to reallocate human resources to higher-value-added tasks. Case studies show that manual review time can be reduced by as much as 70% with appropriate process automation.

Audit cost reduction. According to EY research, large enterprises spend an average of 183 thousand USD on a single large compliance audit, with costs potentially 2-3 times higher in regulated industries. GRC provider case studies show that audit preparation automation can lead to significant cost savings, in some cases even half the cost of traditional audits.

Avoiding penalties and breaches. As mentioned earlier, the average cost of a data breach is 4.88 million USD according to IBM. Even a small reduction in the probability of such an event translates into significant expected savings and protection against financial and reputational losses.

Revenue benefits. Companies with compliance certifications can shorten sales cycles and increase contract values, particularly in B2B segments where data security and regulatory compliance are key vendor selection criteria.

Specific return on investment will depend on organization size, industry, process maturity level, and chosen technological solutions. Payback period for compliance platforms typically ranges from 6-18 months, depending on implementation scale.

What Are the Biggest Challenges in Compliance Management in 2026?

Despite obvious benefits, organisations face significant challenges:

Growing regulatory complexity. As the PwC 2025 study shows, 85% of organisations globally (97% in Ireland) confirm that compliance requirements have become more complex over the past three years. This complexity results from overlapping national, EU, and international regulations and the emergence of new regulatory areas such as artificial intelligence (58% of organisations worry about changes in AI-related compliance requirements) and ESG.

Third-party risk. DBIR 2025 showed that breaches involving third parties doubled from 15% to 30% within a year. Gartner 2025 indicates that over 82% of compliance leaders experienced consequences of vendor risk. Half of organisations are changing their approach to third-party oversight due to changes in US regulatory enforcement, but only 58% check vendor regulatory risk, and only 33% use risk-weighted methods.

Shortage of qualified specialists. The compliance function has expanded far beyond traditional boundaries, requiring interdisciplinary knowledge spanning law, technology, cybersecurity, ESG, and risk management. Thomson Reuters identifies the most important skills for an ideal compliance auditor: substantive knowledge, clear communication, and predicting regulatory trends.

Budget constraints. Despite growing requirements, compliance budgets are not growing proportionally. Gartner’s 2020 study showed stabilization of compliance spending after a period of rapid growth (42% increase per 1000 employees in 2017-2019). Organizations must therefore do more with less, forcing automation and more efficient resource utilization.

Compliance Trends for 2026-2027: What Awaits Us?

Artificial intelligence is transforming compliance. 65% of risk and compliance professionals say AI is already important to their programs, and 80% believe it will have a high or even transformational impact on their work within the next five years, according to Moody’s. AI helps parse regulatory changes, automatically update compliance procedures, and detect risk patterns before they escalate. However, 97% of organisations that experienced an AI-related incident did not have appropriate access controls, and 63% lacked AI governance policies.

Compliance is becoming a strategic business enabler. The PwC 2025 study shows that 77% of respondents point to the impact of growing compliance complexity on their ability to achieve business objectives – but organisations that intelligently manage compliance through automation and a strategic approach transform this obstacle into a competitive advantage. Compliance is no longer perceived only as a cost centre.

Growing importance of ESG and sustainability. The CSRD (Corporate Sustainability Reporting Directive) and other ESG frameworks force companies not only to report but also to implement and audit sustainable actions. 30% of all organisations place environmental regulations in the top 5 compliance risks, and in the energy and natural resources sector, this percentage reaches 50%.

Automation is standard, not an exception. 65% of organisations recognise automation as the most effective way to reduce compliance complexity and costs, according to industry analyses. Companies that don’t automate lose competitiveness—the difference in audit preparation time can be weeks, and in operational efficiency, significant human and financial resources.

FAQ – Frequently Asked Questions About Compliance Programs

Does every company need a formal compliance program?

Yes, though the scope and complexity of the program depends on organisation size, industry, and risk profile. Even small companies are subject to GDPR regulations, accounting requirements, or industry regulations. Lack of a formal compliance program exposes the organisation to regulatory penalties, reputational losses, and increased fraud risk. According to Gartner research, organisations with structured compliance programs and embedded controls experience significantly fewer employee obligation violations.

How long does compliance program implementation take and when will we see return on investment?

A typical compliance program for a medium organisation can be implemented within 3-6 months, while organisations using modern GRC platforms can shorten this time to 8-12 weeks. Return on investment typically appears within 6-18 months, depending on organisation size and automation scope. Some benefits (e.g., reporting automation, audit time reduction) are visible almost immediately after implementation.

What are the key differences between compliance and risk management?

Compliance focuses on adhering to specific regulations, laws, and external standards (GDPR, ISO 27001, NIS2), while risk management has a broader scope and includes identification, assessment, and mitigation of all types of business risks, including strategic, operational, financial, and reputational. In practice, these functions often overlap – compliance is part of regulatory risk management. Modern GRC platforms integrate both functions into a cohesive ecosystem.

Can compliance automation completely replace specialists?

No, automation is a supporting tool, not a human replacement. It can handle a significant portion of routine compliance tasks (monitoring, evidence collection, reporting), but strategic decisions, interpretation of new regulations, risk assessment in a business context, and building a compliance culture still require human judgment and expertise. Automation allows specialists to focus on high-value-added activities instead of manual, repetitive processes.

What are the most important metrics for measuring compliance program effectiveness?

Key compliance KPIs include: number and value of compliance incidents (violations, penalties), audit preparation time, percentage of completed compliance training, number and resolution time of whistleblower reports, response time to new regulations, compliance cost per employee, and results of external and internal audits. More advanced metrics include the ratio of prevention costs to violation costs or compliance program maturity index on a 1-5 scale.

Summary – Compliance as Strategic Investment

A compliance management program in 2025 is not an optional add-on but a strategic necessity and concrete investment in the organisation’s future. Data from IBM, PwC, and Gartner reports clearly show that companies treating compliance proactively achieve measurable financial benefits: avoiding costly breaches (average 4.88 million USD according to IBM), significant operational efficiency improvement through automation (64% better risk visibility, 53% faster response according to PwC), and building long-term value through investor and customer trust.

The key to success is a strategic approach combining appropriate technology (automated GRC platforms), organisational culture (embedded controls instead of sporadic training), and proactive risk management. In the face of growing regulatory complexity (85% of organisations confirm increased requirements) and escalating costs of non-compliance, organisations cannot afford a reactive approach to compliance.

If your company wants to transform compliance from a cost centre into a strategic value-building element, consider implementing the modern AdaptiveGRC platform, which combines risk management, compliance, and audit in one integrated solution.