- 1. Why Have Internal Controls Become Strategic?

- 2. What Are the Key Changes in Risk Management?

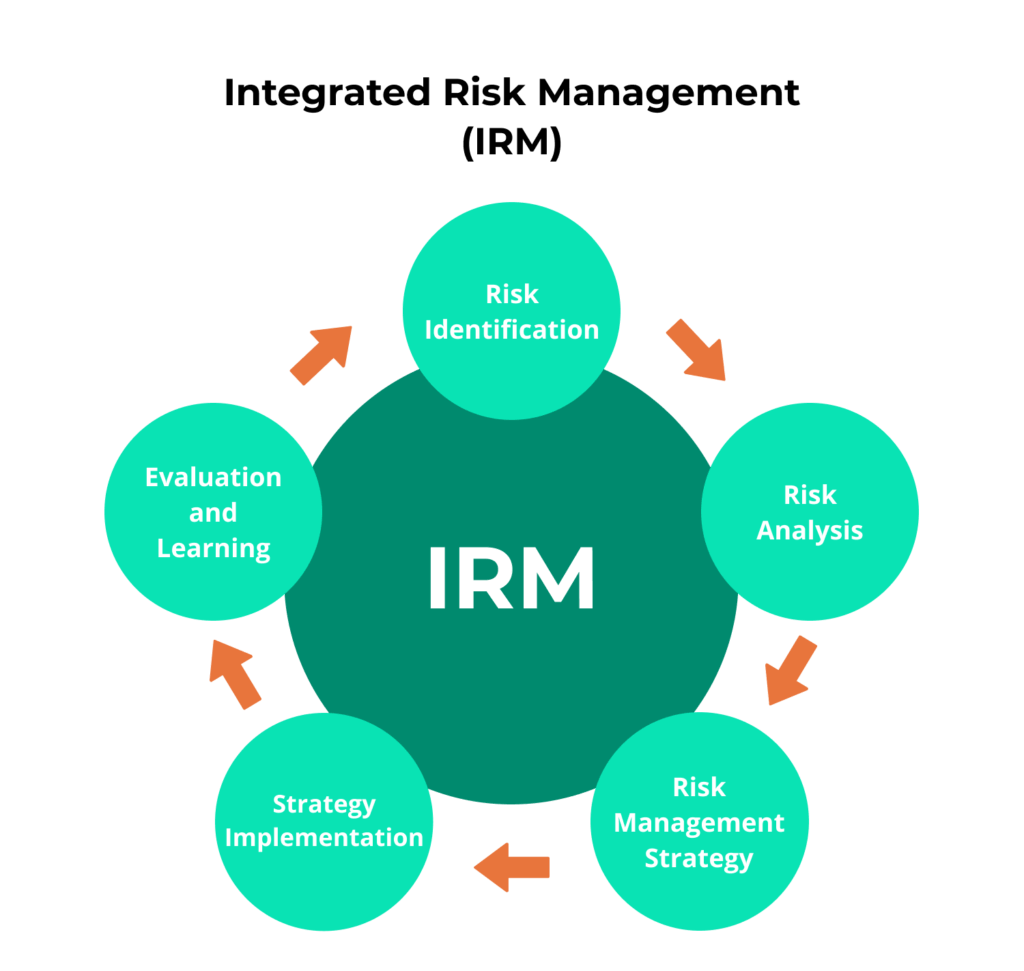

- 3. What Is Integrated Risk Management (IRM)?

- 4. Benefits of IRM Implementation

- 5. How to Find the Balance Between Risk and Opportunity?

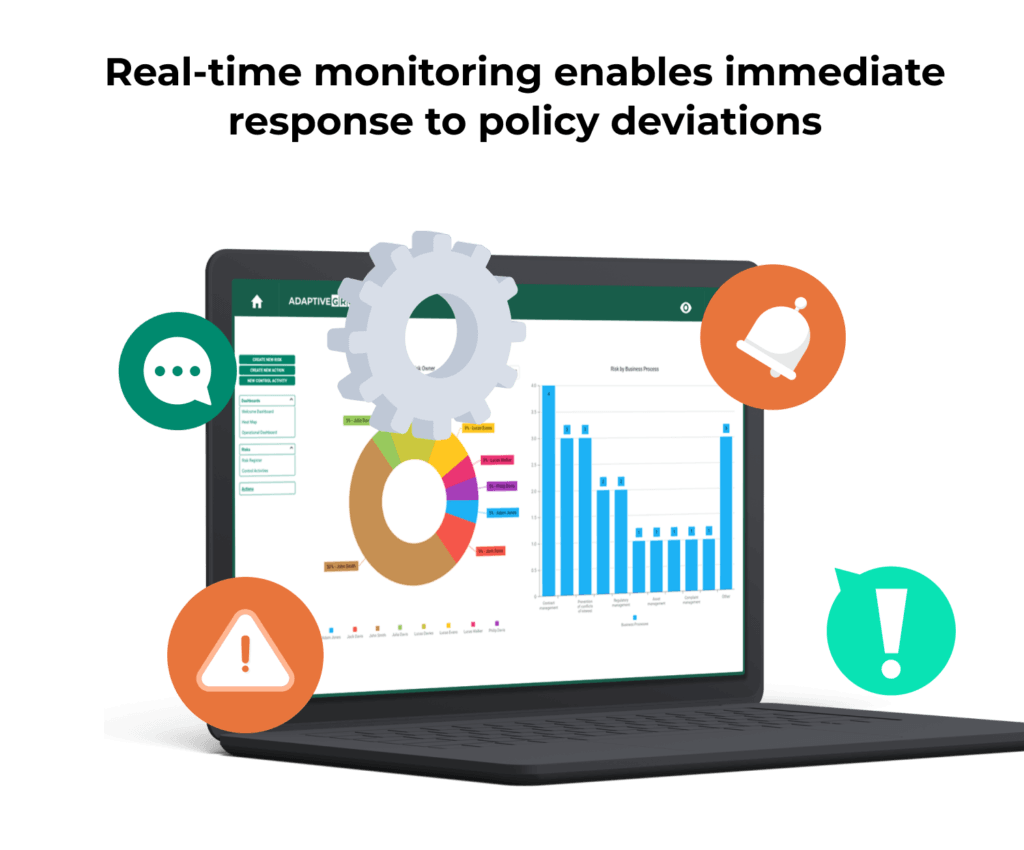

- 6. What Technologies Support Internal Controls?

- 7. How Does AdaptiveGRC Support Internal Controls?

- 8. FAQ – Frequently Asked Questions

Internal controls are evolving from reactive to proactive thanks to automation and AI. Integrated Risk Management (IRM) is becoming the standard, combining operational risks, cybersecurity, and compliance in one system. Key trends for 2026: control automation, real-time monitoring, and balance between risk and business opportunities.

Why Have Internal Controls Become Strategic?

Ignorance of the law is not a valid reason for non-compliance, just as allowing internal controls to become inadequate is no excuse for lack of compliance. Every company is obligated to track changing formal – and informal – regulations, requirements, and circumstances, regardless of size or sector.

The Role of Internal Controls in 2026

According to Empowered Systems, internal controls are undergoing a transformation from reactive to proactive through the integration of AI and machine learning. AI-powered tools can predict and detect potential fraud or regulatory violations, enabling organizations to address problems before they escalate.

A good risk manager should understand how external factors can impact a company’s approach to risk management. When circumstances change, new risks may emerge requiring reassessment of exposure and adjustment of internal controls. A recent example is how companies adapted to the COVID-19 pandemic – the shift to remote work meant risk managers had to create entirely new internal control frameworks.

What Are the Key Changes in Risk Management?

Changes in external circumstances, regulations, and specific risks have driven significant shifts in how companies approach risk management.

Growth in the Importance of Internal Controls

The role and scope of internal controls in companies has grown significantly. While previously such measures and procedures were the domain of large firms, internal controls are now being implemented in organizations of various sizes. According to Deloitte Future of Controls, companies are leveraging digital transformation and control automation to reduce pressure on internal control functions regarding cost reduction, efficiency improvement, and effective risk management.

Automation not only streamlines routine tasks but also complex processes such as audits, fraud detection, and risk assessments. Using AI for real-time data analysis allows internal control teams to identify anomalies and irregularities much faster than manual methods.

Reports as Operational Tools

Internal control reports are treated as important operational and planning documents, not just formal compliance obligations. Modern organizations use them to make strategic business decisions, identify areas for optimization, and monitor the effectiveness of implemented corrective actions.

According to TechTarget, a comprehensive GRC platform can provide a critical integration layer for all types of risk management activities, enabling policy creation and management, conducting risk assessments, and automating the internal audit process.

Benchmarking and Trend Analysis

Comparative audit methods facilitate year-over-year or time-period comparisons. Organizations can now precisely track risk exposure and implemented internal defensive measures, comparing results over time and identifying trends before they become critical. This historical analysis capability is crucial for predictive risk management.

IRM as a Foundation for Business Continuity

Particularly since the pandemic, Integrated Risk Management (IRM) has become essential for ensuring business continuity and robust enterprise operations, especially in manufacturing companies. According to Moody’s, companies are moving from fragmented data and risk management systems to a connected, strategic approach – which unlocks opportunities while strengthening resilience.

For example, Singapore-based fintech firm Penguin Securities achieved a 70-80% reduction in onboarding time through implementation of a unified risk platform that integrated all compliance and due diligence processes.

What Is Integrated Risk Management (IRM)?

According to Gartner’s definition, integrated risk management is “a set of practices and processes supported by a culture of risk awareness and technologies that enable improved decision-making and performance through an integrated view of how well an organization manages its unique set of risks.”

Key IRM Components

Unified visibility across the organization is the first pillar of effective IRM. Instead of separate risk registers for operations, IT, compliance, and finance, IRM combines all risks in one place. Centraleyes emphasizes that too many tools and too little clarity is a growing problem – when teams must pull data from a dozen sources just to get a risk snapshot, everything slows down.

Real-time dashboards and strategic reporting provide a complete picture of risk and compliance position at any moment. The ability to generate audit-ready reports or board summaries in a few clicks transforms internal controls from a burden into a strategic tool.

Integrated workflows and collaboration enable assigning remediation tasks, tracking deadlines, and engaging stakeholders from different teams from within the platform. Everyone stays synchronized and nothing falls through the cracks. According to ISACA, a connected approach to risk breaks down silos, ensuring every area of the organization works together in anticipating, managing, and transforming risks into opportunities.

Benefits of IRM Implementation

Organizations implementing IRM report measurable benefits. Time spent on manual processes is reduced by 40-60%, and incident response speed improves by 50-70%. More importantly, IRM transforms risk management from a compliance cost center into a strategic business value driver.

Companies with mature IRM programs are also better prepared for regulatory audits – full process documentation, automatic audit trails, and centralized evidence significantly shorten audit times and reduce their costs.

How to Find the Balance Between Risk and Opportunity?

The current financial crisis, supply chain problems, and effects of armed conflict in Ukraine force attention on risk management. However, modern organizations understand that achieving success always involves some risk.

Balanced Approach to Risk

Many companies take a balanced approach to risk – understanding they must find equilibrium between ambition and risk. A company that takes no risks will not succeed, but too much risk can derail success. It’s a delicate balance requiring continuous monitoring and adjustment.

According to FIS Global, transparency is critical for risk management and has the highest impact on risk factors for 38% of financial services firms – more than compliance or even security. Without supporting technology, transparency can be difficult to achieve.

Proactive vs Reactive Management

Traditional risk management was reactive – identifying and responding to problems after they occurred. In 2026, organizations are shifting to proactive risk management, using predictive analytics, stress scenarios, and war games to anticipate potential threats before they materialize.

According to TrustCloud, agile compliance recognizes that regulatory requirements evolve rapidly, particularly in areas such as cybersecurity, privacy, and financial reporting. Regular updates to compliance policies ensure their alignment with emerging regulations, and teams regularly review regulatory trends, adjust internal controls, and refine documentation.

TABLE: Comparison of reactive vs proactive risk management

| Aspect | Reactive Approach | Proactive Approach (IRM) |

| Risk Detection | After incident occurs | Predictive analytics, early warning |

| Assessment Frequency | Quarterly/annual | Continuous real-time monitoring |

| Tools | Excel spreadsheets, manual | IRM platforms with AI/ML |

| Response Time | Days/weeks | Minutes/hours |

| Integration | Functional silos | Holistic organizational view |

What Technologies Support Internal Controls?

Technological advances such as automation and data analysis enable companies to use IRM not only to minimize and manage risk but also as strategic support for business planning.

Internal Control Automation

Automation significantly reduces manual effort while increasing precision and consistency. According to Risk Management Strategies, blockchain smart contracts will automate risk processes such as settlements and compliance checks, reducing counterparty risk in international trade.

Practical automation examples include automatic checking of transaction compliance with company policies before approval, continuous monitoring of access to critical systems with automatic anomaly alerts, automatic generation of compliance reports with full documentation, and robotization of the Three Lines of Defense process.

Artificial Intelligence and Machine Learning

AI is revolutionizing risk detection and control. Machine learning algorithms analyze vast historical datasets, identify patterns, and predict potential threats before they materialize. In cybersecurity, AI can detect anomalies in network traffic signaling potential attacks – often faster and more accurately than analysts.

According to experts, AI-driven risk identification uses machine learning to identify risks more accurately and quickly than humans. This is particularly important in dynamic cybersecurity risk management processes, where heuristic or rule-based approaches can become outdated as adversaries themselves use AI to mount new attacks.

Continuous Monitoring and Real-Time Alerts

Continuous monitoring is replacing periodic audits as the standard in risk management. Integrating real-time monitoring tools into compliance processes allows organizations to immediately detect deviations. Automatic alerts flag policy violations, suspicious activities, or data anomalies before they escalate.

These tools improve transparency, reduce manual oversight, and accelerate response times. By identifying risks early, companies avoid unnecessary penalties while strengthening operational resilience and confidence in their compliance frameworks.

How Does AdaptiveGRC Support Internal Controls?

AdaptiveGRC is a modern tool providing process automation in the GRC area and can be fully customized to manage all types of risks.

Key Platform Capabilities

Centralization of internal activities in one system eliminates fragmented approaches and ensures a consistent organizational view. AdaptiveGRC combines risk management, compliance, internal audit, and internal controls in a unified platform where all elements are interconnected and mutually supportive.

Workflow automation allows defining complex control processes with automatic escalations, assignments, and deadlines. The system automatically notifies responsible individuals of required actions, tracks progress, and generates alerts about delays or risks. This automation drastically reduces manual effort while increasing consistency and timeliness.

Processing large data volumes is crucial in complex organizations generating thousands of events, transactions, and control points daily. AdaptiveGRC provides scalable infrastructure for collecting, processing, and analyzing this data, transforming it into actionable insights for management.

Change Monitoring and Rapid Response

This approach enables real-time change monitoring and response in the shortest possible time. When new regulations take effect, the system can automatically identify affected areas, assign policy and control update tasks, and track change implementation. When an internal audit detects control weakness, the system automatically initiates the CAPA (Corrective and Preventive Action) process with full documentation and tracking.

Integration with other systems via API enables automatic data retrieval from source systems (ERP, HR, IT), eliminating manual data entry and associated error risks. This integration also ensures internal controls operate on current, reliable data without time delays.

FAQ – Frequently Asked Questions

What is the difference between internal controls and risk management?

Internal controls are specific mechanisms, procedures, and internal actions implemented to mitigate identified risks. Risk management is a broader process encompassing identification, assessment, prioritization, and monitoring of risks. You could say internal controls are the “what” (specific actions), while risk management is the “why” and “how” (strategic process). IRM combines both elements into a cohesive whole, where controls are automatically linked to the risks they’re meant to mitigate.

How often should internal controls be updated?

In the traditional model, controls were reviewed once a year. In the era of IRM and automation, controls should be continuously monitored and adjusted in response to changing risks. Formal reviews should occur at least quarterly, but the system should automatically flag controls requiring updates when: regulations change, new risks are detected, existing controls prove ineffective, or significant changes occur in business processes. IRM platforms can automate this process, proactively suggesting control updates based on trend analysis and changes in the risk environment.

Do small companies need formal internal controls?

Yes, though in simplified form. Even small organizations face financial, operational, and compliance risks. According to 2026 trends, internal controls are no longer the exclusive domain of large firms – small organizations are also implementing them, adapting scope to their size. Small companies can start with basic controls in critical areas (e.g., segregation of duties in finance, customer data access controls, basic backup procedures) and gradually develop the system as the organization grows. Modern SaaS GRC platforms offer scalable solutions affordable for smaller companies.

How to prepare for an internal controls audit?

Preparation for audit using an IRM system is much simpler than with manual management. Key steps include: ensuring the risk register is current and controls are mapped to risks, verifying all controls have assigned responsible owners, checking documentation completeness for critical controls, reviewing control testing results from the last 12 months, preparing a report on implemented corrective actions (CAPA), and scheduling sessions with auditors to present system capabilities. An IRM system significantly facilitates audits through automatic audit trails documenting all changes, central repository of evidence and documentation, ability to instantly generate reports for auditors, and transparent view of control effectiveness and remediation status.

Summary – The Future Belongs to Integrated Systems

Companies should track and understand both external and internal factors affecting their risk profile. Internal controls and risk management can no longer function in silos – integration has become a business necessity in 2026.

Key trends:

- Growing importance of internal controls in organizations of all sizes

- Shift from reactive to proactive risk management

- Automation and AI as foundations of modern controls

- Real-time monitoring replacing periodic audits

- IRM as standard for ensuring business continuity

Technology as enabler:

- Automation reduces manual effort by 40-60%

- AI detects anomalies and risks faster than humans

- IRM platforms provide holistic organizational view

- Continuous monitoring enables immediate response

Risk-opportunity balance:

- Success requires taking risks, but in a controlled manner

- Transparency is crucial – 38% of companies identify it as the most important factor

- Proactive approach transforms risks into strategic opportunities

AdaptiveGRC as a modern tool provides process automation in the GRC area, can be fully customized to manage all types of risks, and enables change monitoring and response in the shortest possible time while processing large data volumes.

Ready to transform your internal controls? Contact us for a free consultation and demo of the AdaptiveGRC platform.