In the rapidly evolving corporate world, Environmental, Social, and Governance (ESG) reporting is no longer just a regulatory formality but a strategic component that significantly influences long-term business success. With the impending Corporate Sustainability Reporting Directive (CSRD) set to reshape the landscape in 2024, businesses are urged to integrate ESG criteria into their core strategies and daily operations.

The Importance of ESG in Modern Business

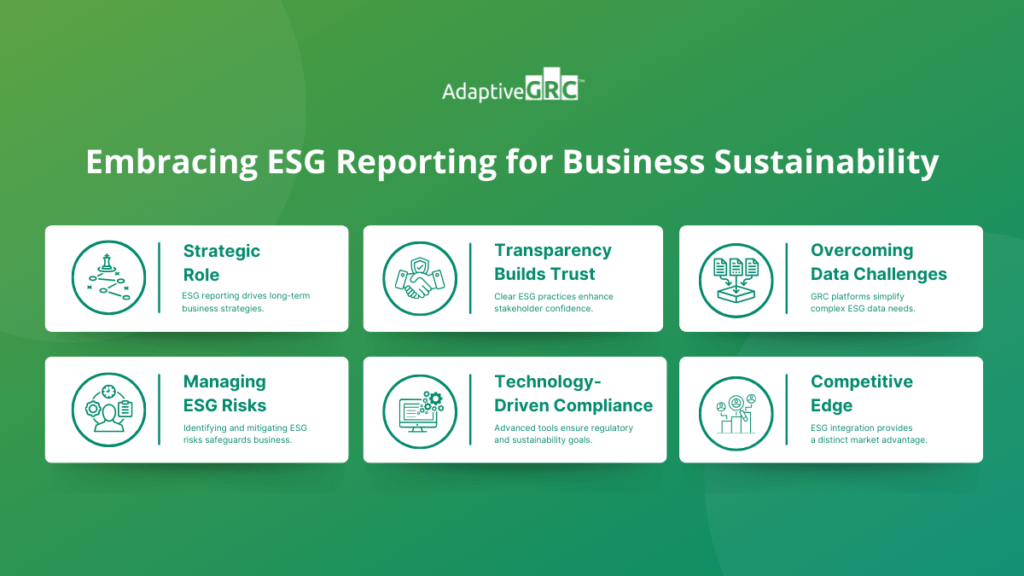

ESG reporting has gained prominence as stakeholders increasingly demand transparency and accountability in sustainability, social responsibility, and ethical practices. This shift is not merely about compliance but about embedding these criteria into the fabric of business operations to enhance enterprise value and ensure long-term viability.

Challenges in ESG Reporting

ESG reporting presents several challenges for companies, primarily due to the complexities involved in data collection and the absence of a standardized global framework. Companies often struggle to gather accurate and comprehensive data that reflects their environmental, social, and governance impacts. These challenges emphasize the need for robust systems, such as a comprehensive GRC platform, that can handle complex data and ensure compliance with regulatory standards.

Integrating ESG with Risk Management

Effective ESG integration begins with robust risk management. Identifying potential ESG risks — be it environmental issues like carbon emissions or social concerns like gender pay inequity — is crucial. Businesses must assess the significance and likelihood of these risks, developing risk management strategies to mitigate them. This proactive approach not only safeguards against potential damages but also aligns with broader business objectives and stakeholder expectations.

Leveraging Technology for Sustainable ESG Management

To address these challenges, advanced technological solutions like AdaptiveGRC, integrated with Forward Earth’s environmental management module, play a crucial role. This integration facilitates efficient management of ESG risks and supports accurate metrics reporting. By focusing specifically on environmental data, it aids companies in navigating the complexities of data collection for sustainability reporting. This technology ensures that businesses can meet evolving regulations while advancing their sustainability goals.

The Role of Internal Audit in ESG

Internal audit functions are integral to ESG efforts, providing risk-based and objective assurance, advice, and insight. By reviewing the implementation of ESG programs and the accuracy of ESG reporting, internal auditors ensure that the reported data is reliable and that the ESG strategies are effectively contributing to the organizational goals. This underscores why regular audits are important: they maintain the integrity and accuracy of ESG reporting, ultimately supporting better decision-making and accountability.

Conclusion

As regulations tighten and stakeholder expectations grow, the ability to effectively manage and report on ESG factors becomes increasingly critical. Companies that integrate ESG considerations into their risk management frameworks and leverage advanced technological solutions will not only stay compliant but also gain a competitive edge in the sustainability-driven market. The partnership between AdaptiveGRC and Forward Earth exemplifies how combining expertise in governance, risk management, and environmental software can create a comprehensive solution that addresses the multifaceted challenges of ESG reporting and auditing. To learn more, you can watch our ESG reporting webinar.